The solution would be internal saving, which can be encouraged through public policies. “Women save less. The decision should be transferred to them. This will lead to a relaunching of economic growth,” said Lucian Croitoru, Advisor to the Governor of the National Bank of Romania (BNR) . His statement is based on a poll ordered by the Deposit Guarantee Fund in the Banking System (FDGB), involving 1,600 respondents, showing that 28 percent of households are led by women, lowering the chances of savings. What should men be doing in this time? First, they should be concerned about their retirement, unemployment, or illness. Indirectly, this could strengthen the economy if and when they are able to impose their familial points of view.

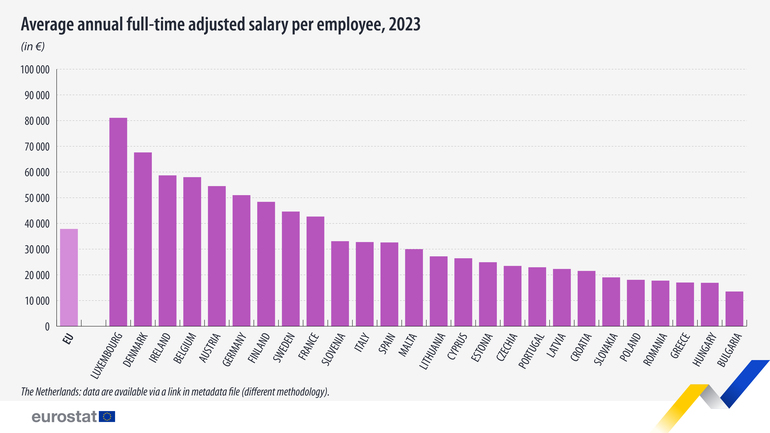

“The current account deficit is dropping. What is Romania doing to sustain investments? Either internal saving rises, or investments will drop. We do not have much choice. We must increase savings,” said BNR’s Chief Economist, Valentin Lazea. The savings rate in Romania now stands at 18 percent of gross domestic product (GDP), up slightly from two years ago, but one of the lowest rates in Europe. “We might be heading for 25 percent,” said BNR Governor Mugur Isărescu in a response to a question by Business Standard on how satisfactory this indicator is. This means that Romanians consume a mere three quarters of what they produce, with the rest being invested.